6 Tips for Building a Data Driven Organization

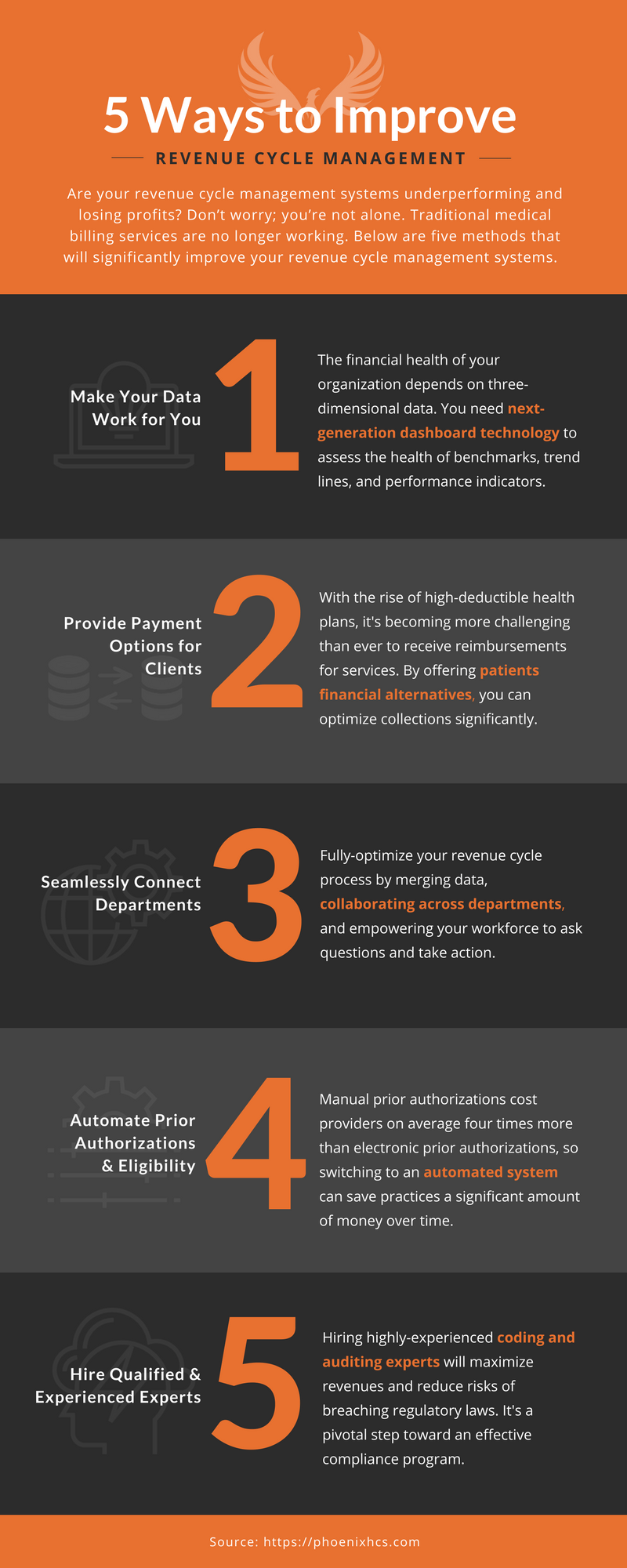

UPDATED (12-25-2020) With the challenges of COVID-19, the world is changing expeditiously, and this reality holds even truer to the world of data management. The first industrial revolution began over 200 years ago and had since evolved into unimaginable interconnected technological advancements. With the conception of the internet, and now AI, possibilities seem endless. No doubt, we are in the middle of a technological revolution. In the years to come, organizations will be forced to restructure their business models and methods. The ones who do not will fail. This shift is causing some practices to dig their heels in and give more of the same, instead of adjusting — utilizing new data-driven tools and methodologies available to their company.

The enterprises that invest significant resources in building a data-driven culture will flourish — leaving the competition dazed and confused. The problem lies in that businesses don’t always know where to begin. The power of data can be both exciting and bewildering. It can make (or break) a company, so it’s important to not only approach data strategically but to align yourself with the right data specialists.

The following six tips stem from over a decade of collaborations with hundreds of organizations that we’ve helped in becoming sustainable, data-driven entities.

TIP 1: Create a Data Strategy

Many C-level executives assume that creating a data strategy involves modifying their organization’s goals for the year—which would be a daunting undertaking. It doesn’t take long to convince the organization leads to reconsider once they realize that data strategies can be designed for different sub-teams while maintaining alignment with the company’s primary goals.

Uncovering hidden information about your clients, your business, and even your competition can propel your business to another level. When data is seen as an asset, rather than just a mundane tool, it has the potential to both improve financial decisions and enhance core company goals.

TIP 2: Equalize Your Data

The next tip entails balancing your data throughout your entire organization. Whether it’s your lab technologist, pathologist, or the company’s chief executive officer; decisions need to be made. Providing your team with the right data will ultimately help them make better decisions.

For some organizations, this is easier said than done. A multitude of obstacles can arise, such as privacy laws and other constraints that can risk liability repercussions.

So, the big question is; how can your company effectively disperse data? It’s simple; provide the appropriate data to relevant personnel. By taking people’s roles and responsibilities into account, you can ensure the right data gets to the right individual—magnifying their ability to make better decisions.

TIP 3: Develop a Data-Driven Culture

The next tip involves building a data-driven culture within your organization. We don’t just promote this idea. We’ve been applying it to our business model since day one. Being that data can perplex some people, it needs to be encouraged and often incentivized among employees. Team members that utilize data need to be rewarded in different ways.

Another critical component for increasing ROI is to bridge the gap between teams—helping them to work together more efficiently. The best way to do this is to educate teams. Having a better understanding of how different teams function will ensure greater collaboration and communication between employees.

TIP 4: Prioritize, Prioritize, Prioritize

Measuring the value and impact of your organization’s data is an essential part of becoming a data-driven machine. Prioritizing data with the highest ROI, rather than trying to act on all data ensures an increase in profits, as well as a decrease in overall staff-hours—improving your company’s bottom line.

One way to prioritize your data is to consider the investment’s potential impact. Will it provide the financial freedom to expand the growth of your business? Or will it produce mediocre profits? If it’s the former, you have an opportunity to invest more money and time to a particular project.

As your organization becomes more efficient in using data science to identify and prioritize opportunities with high probability and impact, teams will grow in confidence and make better decisions in the years to come.

TIP 5: Accelerate Insight Data

The goal here is to distribute data and insight into your business throughout your organization. Delivering compelling insight to decision-makers in a speedy fashion will progressively develop data-driven, decision-making habits. Utilizing data to generate as much insight as possible is vital in cultivating a data-driven culture within your company.

One of the most useful ways to foster a data-driven culture throughout your organization is to leverage the power of performance dashboards. The incredible insight that these tools provide is unparalleled—giving your organization a competitive advantage that’s difficult to rival. Too many businesses are failing to experience the benefits of using these technological tools—causing them to overlook many opportunities. Maybe it’s a fear of the unknown, or perhaps it’s stubbornness, but one thing is for sure; data-driven performance dashboards are the future.

TIP 6: Build a Data Framework

Data is useless—even threatening—when it’s unsecured and scattered. One of your organization’s top priorities should be to protect its data. Data governance and privacy measurements need to be implemented in your organization if it expects to maintain an errorless track record.

The most effective companies invest in a data framework that clearly defines (and regulates) data streams. Understanding various data paths, data models, as well as the tools that your data interacts with will assure governance from the start.

Having a strong data framework in place will reinforce team morale and position your organization as a trustworthy pioneer in its space.

Final Thoughts

Building a data-driven organization may seem like an intimidating endeavor. It will undoubtedly demand a new approach to data—empowering your organization to maximize its use and stability of data science within every decision made. In time, your team will adjust, and the once intimidating idea of running a data-driven organization will be a reality.